- LIST OF MONTHLY BILLS TEMPLATE HOW TO

- LIST OF MONTHLY BILLS TEMPLATE SOFTWARE

- LIST OF MONTHLY BILLS TEMPLATE DOWNLOAD

- LIST OF MONTHLY BILLS TEMPLATE FREE

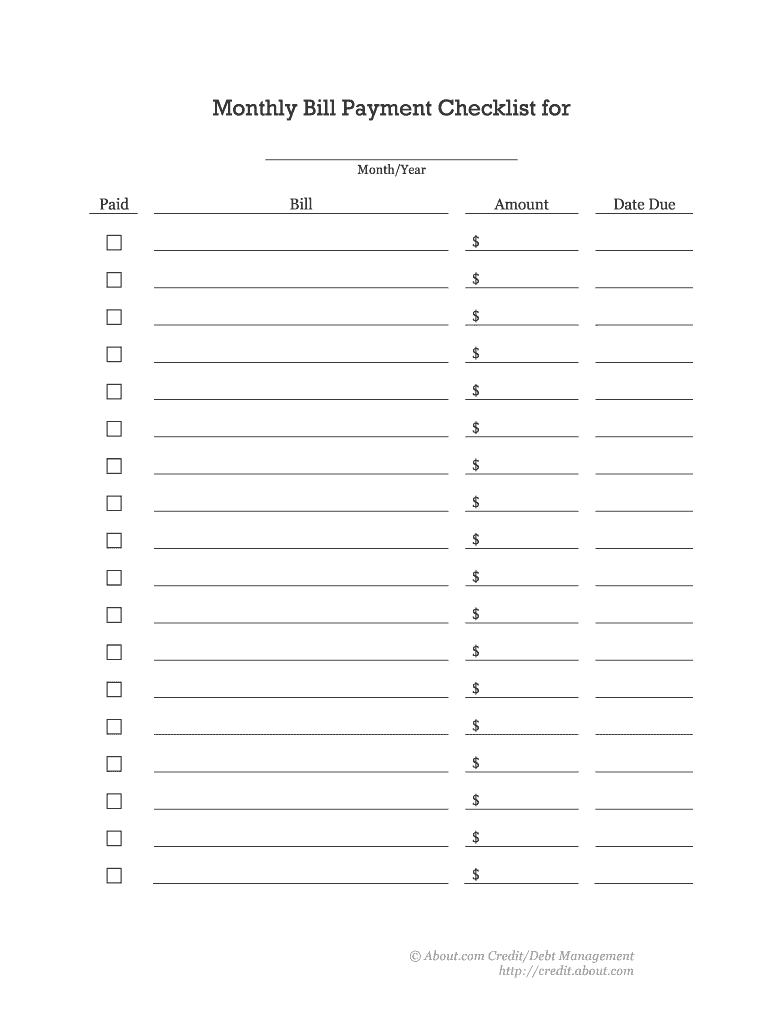

This serves as a heading for all of your income items. Start by inputting “Income” in the first cell. Although this is an optional column, it allows you to check whether or not you have already paid your bills and other payments. Move to the right again then input “Paid” or some other similar term. Move to the right then input “Due Date.” This column records the due dates of your payments or bills. This column records the value of all the other items on your sheet. Skip the 1st cell then in the next cell, input “Amount.”.

LIST OF MONTHLY BILLS TEMPLATE SOFTWARE

If you don’t have software like Microsoft Excel installed in your computer, you can use the software of your choice. Launch the spreadsheet software of your choice.Here are the steps to follow when making your own monthly budget template: In the long run, you will discover yourself coming closer to financial freedom. You can use the template as a guide to pay your bills, save money or make it to your next payday without getting into debt. Some think that this is a difficult task but it will make it easier for you to keep track of your finances. One way to have control of your expenses is through the use of a monthly budget template. Monthly expenses template 30 (18.24 KB) How do I create a monthly expense spreadsheet? Some of the latest ones allow you to keep track of your investments too. If you have a more comprehensive financial portfolio, you may opt for a budgeting app instead.

LIST OF MONTHLY BILLS TEMPLATE DOWNLOAD

You can find many of these templates online and download them for free. There is a lot you can discover when you go through this process. Some credit cards tag your purchases automatically in categories making things easier for you. Through this, you get a sense of your cash flow each month.Īfter going through your accounts, group these into categories. Looking through these accounts helps you pinpoint your spending habits. Identify all of your money habits then create an inventory of all your accounts including all of your credit cards and your checking account.

LIST OF MONTHLY BILLS TEMPLATE HOW TO

Here are pointers to consider on how to start tracking through your monthly expenses template:

It is a good practice to keep track of your expenses regularly through a bill tracker template as this gives you an accurate overview of where you’re spending your money. When making your monthly bills template, here are some examples of monthly expenses to include: These are expenses that you cannot do without as these keep you warm, alive, and safe. Before you make a budget, you should first have a list of your individual expenses.įor instance, take your needs.

In general, a budget contains spending guidelines for specific expense categories. Identifying recurring and common expenses like mortgage or rent payments, helps you plan your expenditures and make a monthly expenses template.

LIST OF MONTHLY BILLS TEMPLATE FREE

Here is the collection of best printable budget templates broken down by categories (they are 100% FREE and downloadable, but may contain watermarks and uneditable).Monthly expenses template 20 (62.55 KB) What are examples of monthly expenses? But if you like to plan everything with pen and paper, then budget printables will be a perfect solution for you. If you’re 100% digital person, you’re likely to google a smartphone app, excel templates or any other best online budgeting sites. When it comes to tools that can help you achieve that, there are plenty of mediums to choose from. A great advantage of having a budget is a possibility to track your spending habits over time and adjust them accordingly. It’s to help you plan for how, what for and how much money will be spent or saved during a particular period of time. A budget is a structured list of your personal or household expected income and expenses. Whatever you may need money for, it’s important that you stick to your budget day in and day out. You don't want to get a negative balance of your credit card, don't you? Moreover, keeping track of your finances can play an important role in the pace you improve your savings account balance and save money for your dream vacation, house or car. In the world of consumerism, it’s easy to spend a few bucks here and there to suddenly find out that you exceeded your daily, weekly or monthly budget. The ability to manage your cash flow and track your income and expense is vital. Because it's not only business people who care about profits and expenses. It's no wonder why one of the many tips on personal finance management is to make budget.Īnd you don't have to be a financial specialist to do that. What can be more important than time management? Correct.

0 kommentar(er)

0 kommentar(er)